In recent years, cryptocurrencies like Bitcoin, Ethereum, and many others have gained immense popularity MetaMask, revolutionizing the way we think about money. However, owning and managing cryptocurrencies requires specialized tools—one of the most important being a crypto wallet. In this article, we’ll explore what a crypto wallet is, the different types available, how they work, and why securing them is crucial.

What is a Crypto Wallet?

A crypto wallet is a digital tool or application that allows you to store, send, and receive cryptocurrencies. Unlike traditional wallets, which hold physical money, a crypto wallet doesn’t store the digital currency itself. Instead, it holds private keys, which are cryptographic keys that provide access to the blockchain—the digital ledger that tracks cryptocurrency transactions.

Each cryptocurrency has a unique public key (like an account number) and a private key (like a password) that together enable users to conduct transactions securely. These keys are necessary for signing transactions and ensuring that only the rightful owner can access and transfer the funds.

Types of Crypto Wallets

Crypto wallets come in various forms, each with its own strengths and weaknesses. The two primary categories are hot wallets and cold wallets.

1. Hot Wallets

Hot wallets are connected to the internet, making them easily accessible and convenient for day-to-day use. They are typically used for storing small amounts of cryptocurrency that you need for quick transactions. Hot wallets can be further divided into the following types:

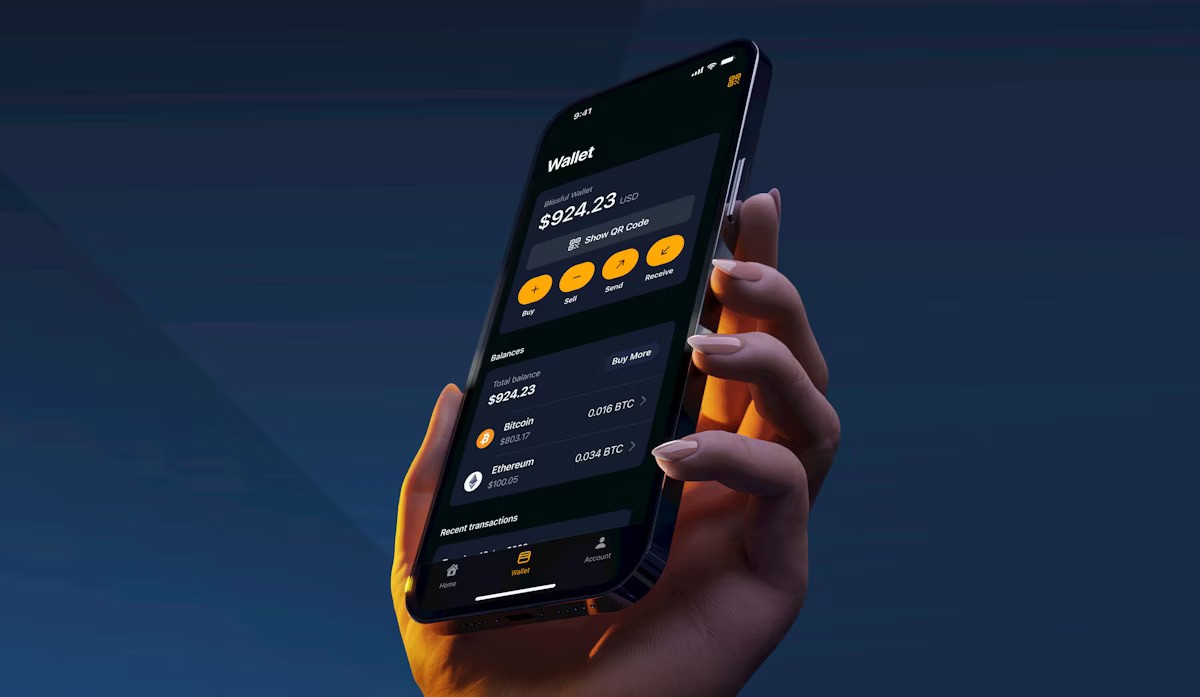

- Software Wallets: These wallets are applications or programs installed on your computer or mobile device. Examples include Exodus, Electrum, and Mycelium. Software wallets are popular because they’re easy to use and allow users to manage multiple cryptocurrencies.

- Web Wallets: These wallets are accessed through a browser, such as MetaMask or Blockchain Wallet. Since they are cloud-based, users can access their funds from any device with an internet connection, but this also makes them more vulnerable to online threats.

- Mobile Wallets: These are apps specifically designed for smartphones (e.g., Trust Wallet, Coinbase Wallet). They provide great accessibility for mobile users, but like other hot wallets, they are susceptible to hacks or malware if the phone is compromised.

2. Cold Wallets

Cold wallets are not connected to the internet and are used to store cryptocurrencies offline for added security. These wallets are ideal for long-term storage of large amounts of cryptocurrency. There are two main types of cold wallets:

- Hardware Wallets: Physical devices, such as Ledger or Trezor, that store private keys offline. These wallets are immune to online attacks and malware because they don’t rely on an internet connection. They offer high security but require physical access to the device.

- Paper Wallets: A paper wallet is a physical document that contains your private and public keys, often printed in QR code format. While this method provides a high level of security (since it’s offline), it comes with the risk of physical loss or damage.

How Do Crypto Wallets Work?

When you create a wallet, it generates a public key (address) and a private key (secret code). The public key is shared with others so they can send cryptocurrency to you, while the private key is used to sign transactions, authorizing the transfer of funds.

When you want to make a transaction, you use your wallet to create and sign the transaction with your private key. This signature is then verified by the blockchain network, ensuring the transaction is legitimate. Once confirmed, the funds are transferred, and the blockchain records the transaction.

Security Considerations

While crypto wallets offer significant benefits, they also come with security risks. Since your private keys control access to your cryptocurrencies, losing them or having them stolen can result in irreversible loss. Here are some best practices for securing your crypto wallet:

- Backup Your Wallet: Always back up your private keys or recovery seed phrase in a secure location. Many wallets provide a 12-24 word phrase that can help you restore your wallet if you lose access.

- Use Two-Factor Authentication (2FA): For hot wallets, enable 2FA to add an extra layer of security to your account.

- Keep Software Updated: Regularly update your wallet software to protect against vulnerabilities and exploits.

- Avoid Public Wi-Fi: When using a hot wallet, avoid conducting transactions over public Wi-Fi networks to reduce the risk of hacking.

- Cold Storage for Large Holdings: Store the majority of your crypto in cold wallets, especially if you plan to hold it for an extended period.

Choosing the Right Crypto Wallet

Selecting the right crypto wallet depends on your specific needs and preferences. If you are an active trader or regularly make transactions, a hot wallet might be more convenient. However, if you’re holding significant amounts of cryptocurrency for long-term investment, a cold wallet offers better security.