As cryptocurrency continues to grow in popularity and use, understanding the tools that allow users to manage their digital assets becomes crucial. One of the primary tools in this ecosystem is a crypto wallet. Whether you’re a beginner exploring the world of digital currencies or an experienced trader MetaMask, a crypto wallet is an essential part of your journey. Let’s dive into what crypto wallets are, how they work, and the different types available.

What is a Crypto Wallet?

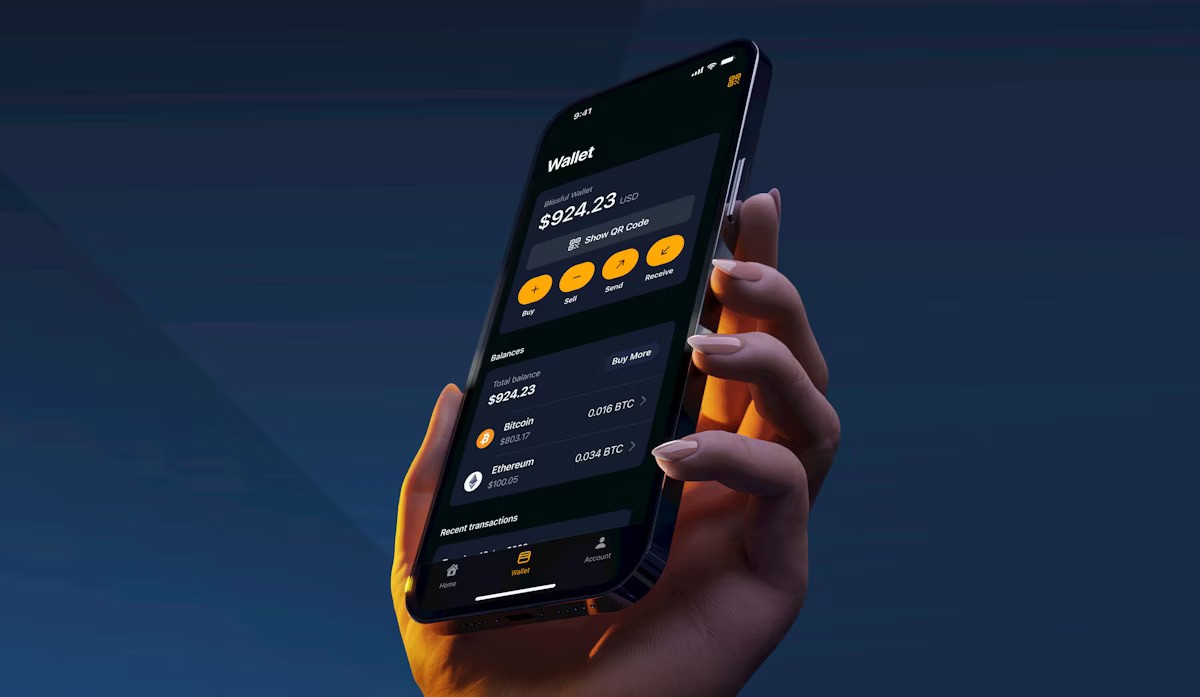

A crypto wallet is a digital tool that allows users to store and manage their cryptocurrency securely. Much like a traditional wallet, which holds physical currency, a crypto wallet holds digital currencies such as Bitcoin, Ethereum, or altcoins. However, instead of physical notes, a crypto wallet stores the cryptographic keys that give you access to your digital assets.

Cryptocurrencies, like Bitcoin, are decentralized and not held in a central location. This makes crypto wallets important for safely storing and interacting with these assets, ensuring that only you have control over your funds.

How Do Crypto Wallets Work?

Crypto wallets don’t actually store cryptocurrency in the traditional sense. Rather, they hold private keys and public keys. The private key is a secret code that allows you to access and control the funds stored on the blockchain, while the public key is used to receive funds. When you send cryptocurrency to someone, you are essentially using your private key to authorize the transaction.

Think of it as a lock and key system:

- The public key is like your address — anyone can send funds to it.

- The private key is like the key to that lock — it gives you access to your assets and allows you to sign transactions.

Since losing your private key means losing access to your funds, it’s critical to keep it safe.

Types of Crypto Wallets

Crypto wallets can be divided into two broad categories: hot wallets and cold wallets. Each type has its own advantages and disadvantages based on convenience, security, and how frequently you plan to interact with your cryptocurrency.

- Hot Wallets:

- Definition: Hot wallets are connected to the internet and are designed for easy and quick access to your digital assets.

- Advantages: They allow for rapid transactions, making them ideal for active traders and those who need to access their funds quickly.

- Examples: Software wallets (like Exodus, Electrum), mobile wallets (Trust Wallet, MetaMask), and web wallets (Blockchain Wallet).

- Risks: Because they are connected to the internet, hot wallets are more vulnerable to hacking or malware attacks.

- Cold Wallets:

- Definition: Cold wallets are offline storage options that are not connected to the internet, offering higher security.

- Advantages: Cold wallets are generally considered safer for long-term storage of cryptocurrency due to their resistance to online threats.

- Examples: Hardware wallets (like Ledger, Trezor) and paper wallets.

- Risks: While secure, cold wallets can be more cumbersome to use, and there is always a risk of losing your keys or physical device.

Choosing the Right Wallet

When choosing a crypto wallet, it’s essential to consider your needs. Here are some factors to keep in mind:

- Security: If security is your top priority, a cold wallet may be your best option. For everyday transactions, however, a hot wallet may suffice.

- Ease of Use: Hot wallets tend to be more user-friendly, offering easy integration with exchanges, dApps, and other crypto services.

- Access to Funds: If you need frequent access to your funds, a hot wallet will be more convenient. For long-term storage and minimal access, cold wallets are ideal.

- Supported Cryptocurrencies: Ensure that your wallet supports the cryptocurrencies you plan to store.

How to Keep Your Crypto Wallet Secure

Security is paramount when it comes to managing cryptocurrencies. Here are some best practices to protect your wallet and assets:

- Backup Your Keys: Always keep a backup of your private key or recovery phrase in a safe place (preferably offline).

- Use Multi-Factor Authentication (MFA): Many hot wallets and exchanges offer two-factor authentication (2FA) for added security.

- Update Software Regularly: Ensure that your wallet’s software or firmware is always up-to-date to prevent vulnerabilities.

- Beware of Phishing Scams: Be cautious of suspicious links, emails, or messages that could lead to phishing sites designed to steal your private keys.

Conclusion

Crypto wallets are a vital component of the blockchain ecosystem, providing individuals with a secure and manageable way to store and interact with their digital assets. By choosing the right wallet, implementing robust security practices, and understanding how these wallets work, users can confidently navigate the world of cryptocurrency.